I have always liked counting my money. It can be a lot of fun for my ADHD, programmer brain. All sorts of patterns emerge and you can build cool money management things.

My earliest memories of this are a part of my life that some people closest to me know about: Lil Chef’s Bakes. I used to make cookies, bag them, carry them to school, and sell them at the canteen. This was in primary school (maybe JSS 1), and I had it down to a science. I knew how much of each ingredient I needed to make an exact batch and almost exactly how much money I would make per batch, and then I would crunch the numbers. I would account for the money spent on the bags and the electricity my mum would make me pay for. I spent many hours building Excel sheets and tracking it all. I made 100 cedis profit at the end of that venture, and I was damn proud of it.

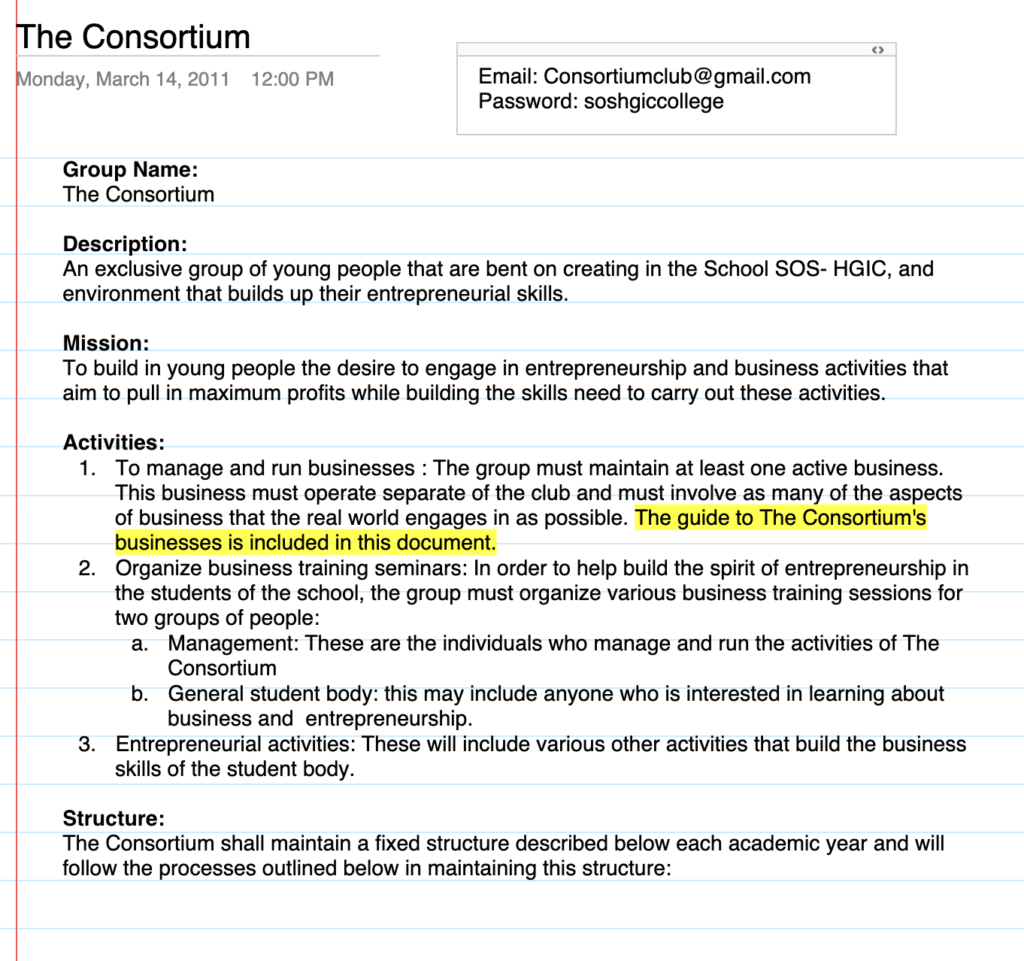

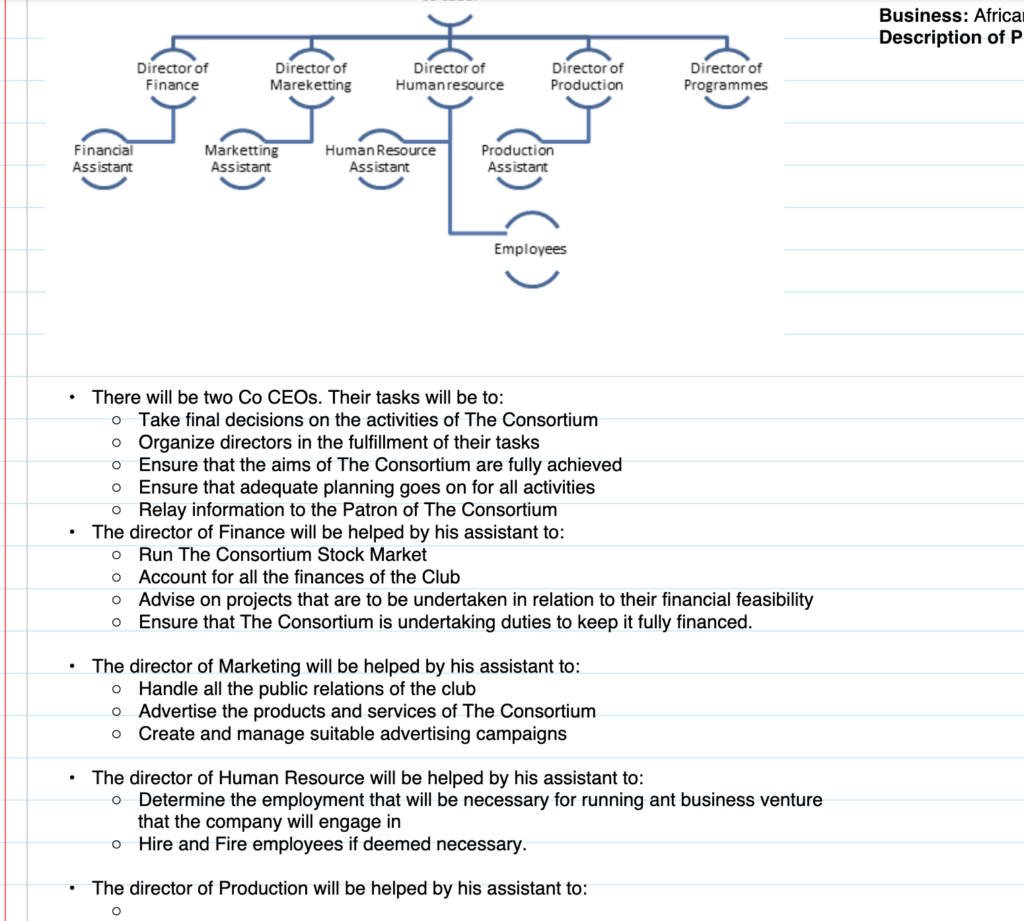

I don’t remember much about money in High School. Writing has a way of bringing back awesome memories 🙂 It was probably the brokest I was in my life because there wasn’t much to track, at least with my personal spending. I was fed three meals a day, a snack and a night cup, and my parents generously provided everything else I needed. I don’t thank them enough. Money was quite dull until I started a business! Consortium Club. Crystal and I would go with Mr Howard to buy things at the Art Center on Accra High Street, and we would come back and sell them on campus. Still kinda boring because I had been there and done that! So, we made it more complex by creating a stock market! That was a lot of fun. Students could buy shares in our business and we paid them back profits on their investments, again all neatly managed in an Excel sheet I would spend countless hours refining.

I found some old notes because I am a digital hoarder:

Once that was done, I got bored again. Guess what? I started another business with Michael Annor: DesignedByLW. Don’t get me started on business finance… money is never boring there. When you run finance for a business, you have to deal with estimates, invoices, taxes, bills, clients, salaries … a lot of money tins! I loved it. I have records that go back to 2014, and it is always fun to see how things evolved. We went from using intricate Excel sheets to all manner of applications and templates. My favourite was Wave. It’s an extremely friendly finance app for business owners, and it got me through a lot. I remember how painful it was initially to port all transactions there, and I’m glad we chugged through it. Business finance always makes things fun.

Somewhere along the way… in 2014, Bryce introduced me to YNAB. It transformed my personal finances drastically. It is the one finance tool I have always recommended since. To this day, one thing that tickles me the most is that I have a record of (almost) every single transaction I’ve made since (and I went to check) 21/05/2014!

YNAB has four simple rules that, when paired with their application, work like magic:

- Give Every Dollar a Job

- Embrace Your True Expenses

- Roll with the Punches

- Age Your Money

Fortunately or unfortunately for me, I don’t listen, as you will come to find out soon. These rules create a coherent understanding of how your money works and give you a method for planning where your money goes. Using YNAB made my money so much more visible, and I couldn’t help but play with it. It provided a language for thinking about money that allowed me to hack together several valuable tools.

At this point in my life, I was the richest I had ever been. If the Lord is gracious enough to give you an increase, it typically happens as you grow up. I was a part of the University of Waterloo’s Co-Op program, which meant I was in classes for four months, and then I worked a full-time, full-pay job for the next four months. I immediately realized I needed to split my co-op income over eight months. I had to create a system within YNAB that allowed me to store cash for a future (potentially very wintery) time. I was already breaking the simplicity of YNAB with my hacky ways, but it worked wonderfully. I was only ever broke just before a new co-op term.

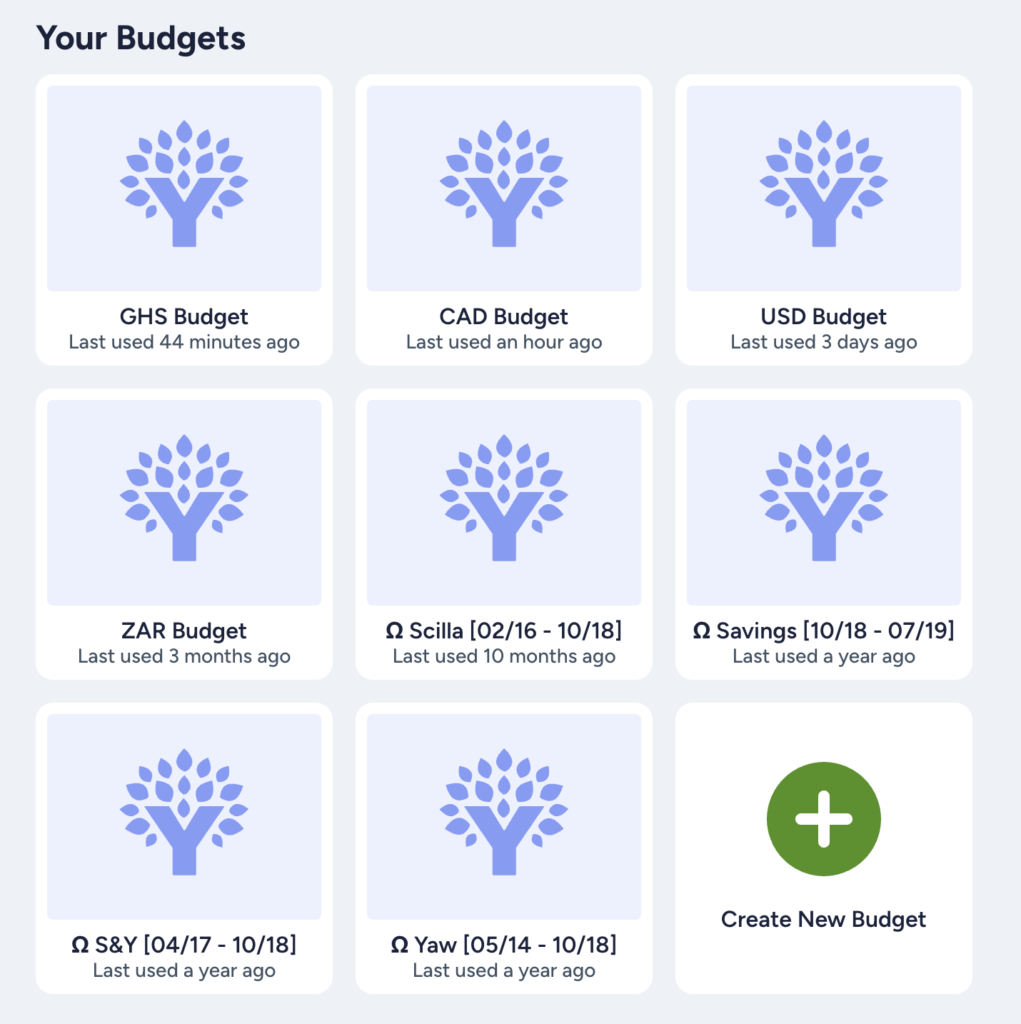

This worked well until I took a gap year in Ghana. That year began my woes with YNAB Multicurrency, and I suddenly had to make sense of a budget split into CAD & GHS. It has always been hard for me to handle multiple currencies in YNAB. I currently handle four different ones across different interests, and getting to this point has been a lot of untangling. Most of my woes are because I build all these complex systems on the language of my money to help me make sense of it. There were also no good answers I could find at the time. I had systems for

- Co-op Income splitting

- Lending large sums of money

- Sharing finances with Scilla, which got interesting

- Suddenly, having to pay my international school fees

- Mixing business and personal money.

And I had to do all of those in 4 currencies. There were a lot of fun nights of counting money.

There was also a point at which YNAB switched from a one-time payment desktop app to a web app subscription. They changed some logic that dictated how money in an overspent category rolled over to the next month. I agree with their new system’s generic benefits, but it doesn’t always work for edge cases, and I was a basket of edge cases. Many of these edge cases led me to discover and become a power user of the YNAB API, one of the most straightforward but helpful APIs I have ever encountered. Imagine hacking away and automating all the current information about your money. One of my first creations with it was an Excel sheet I call Big Expenses. I wanted to track the money we had saved across currencies to achieve big shared financial goals, and I hacked an Excel sheet and YNAB API together. It was (and still is) if I dare say so myself, a work of art! It was a financial dashboard, and I could see it all.

As you can imagine, I introduce a lot of complexity. And I can’t always catch myself. There is a significant decision people tend to have to make that Scilla and I have explored for a long time: Should you combine your finances with your partner? We have done that for a long time. Ever since we realized as a dating couple that we will have shared expenditures, there has been some interesting YNAB hack to make it work, and it has grown wings on the back of my love for counting money and the fun I have hacking. It got too complex, and money, which we had never had an issue with, became big. Scilla would get lost in my hacks, and I would struggle to maintain complex systems.

One of the things the conversations we had taught me is that there is some freedom in simplicity. They taught me to let go of many complex systems that weighed us down. We have managed to untangle many things that were breaking our financial planning process and create simple rules and patterns that have trended back towards YNAB’s four simple rules (duh). This post was sparked by reading this Guide to YNAb Multi-Currency and realizing many more things I could let go of to count my money better.

It doesn’t mean that I don’t get to have fun. I’m still a tinkerer at heart, and I will build where there are fun things to poke at. My latest invention: YNAB to Notion! I’m quite the Notion nerd and thanks to the existence of another beautiful API and my new best firend, N8N, I have built some nifty financial planning tools in Notion, fed directly by live YNAB Data and fully supporting Multi-Currency. I love it so much. But now, I think deeply about what I’m building and why. Sometimes, it’s just a way to hack things and discover. Other times, I need a clearer financial picture and I can paint it in my hacks. All the time, it is fun.

There are a few things I’ve reflected on in writing this post that are worth mentioning. First, it’s going to be really fun when AI takes over and can see the pictures I’ve painted of my financial portfolio and collaborate with me on it. The robots are coming, and I feel ready!

Finally, I want to talk about the biggest feature that has been thread in all of my money counting:

Space for Grace

I often find at the end of a budgeting session that there isn’t enough money for our financial goals! I won’t complain about money; I am blessed and highly favoured! I have lofty financial goals, often beyond the scope of my budget, but the trick is never to look that far. Once I have a decent picture of what my money looks like and what I want to buy, I stop worrying about how the two balances will catch up with each other. I leave some space for Grace to drop some money in my lap, and Grace never disappoints. I have had a lot of fun counting money and have always been divinely provided for. I am grateful for that.

If you are interested in counting your money, let’s chat. I have learnt a lot of really cool things along the way and continue to learn more that I would love to share with you.

Thanks for reading!